With the US duties looming, the Commission is rediscovering “good-old” free trade agreements in a much needed effort of diversification. After the breakthrough with Mercosur, new agreements with Mexico and Switzerland have also been concluded.

Discussions over incoming Trump’s duties should not make us forget last-minute legacy of Biden: export restrictions on AI chips. Some EU countries will be fine, but some are set to face limitations over their imports. Commissioners Šefčovič and Virkkunen’s next mission is to convince Trump to forget about it.

Finally, legislative work over the FDI screening regulation is intensifying, while a new, albeit informal, monitoring on outbound investment as a new must-watch for companies.

The EU in a quest for trade diversification.

As we know from the many news alerts we receive every day, US President Donald Trump can hit the EU with tariffs at any moment – hopefully not right after this newsletter is published. It’s only natural, then, that since November Brussels has been trying to run for cover – consider that many EU countries are now more exposed to trade with the US than 8 years ago. The European Commission has been preparing countermeasures through a taskforce in DG TRADE we don’t know much about, but not before trying “peace offers”, notably purchasing more US defence equipment and gas.

However, a third route to “Trump-proof” EU trade policy is diversification with third countries. In the last two months, the Commission concluded the deal with Mercosur, modernised the existing agreements with Mexico and Switzerland, and reopened talks for an FTA with Malaysia. There’s more in the pipeline, as FTA negotiations with Indonesia and Thailand could make significant progress this year, and those with Australia might be resuming.

Since her inauguration, Commission President Ursula von der Leyen has been talking about broadening the EU trade offer with third countries through more limited, but quicker to negotiate, Clean Trade and Investment Partnerships. Yet, the recent news shows that classical FTAs may not be dead, after all. Even the much talked about Competitiveness Compass – sure, mixed with many calls for economic security, trade defence and levelling playing field – highlights the importance of trade for both EU’s prosperity and economic security. With all the uncertainties coming from the US and China, traditional FTAs can greatly serve the EU’s need for diversification, in spite of the difficulties in finalising and ratifying them.

Zoom out: The crucial offer the Commission could make to Washington is a tougher approach on China. Indeed, EU Trade Commissioner Maroš Šefčovič underlined the will to deepen EU-US cooperation on economic security and Beijing’s non-market practices. Good luck in getting all the 27 EU governments aboard.

Zoom in: Both exposed to Trump’s trade bullying, the EU and Mexico found a new trade agreement, modernising the one in place since 2000. It features new sustainability commitments, investment liberalisation, and removal of tariffs on certain EU agri-food products. As for any FTA, ratification won’t be a walk in the park, but the debate won’t be as tense as for the deal with Mercosur, either.

A year of agri-trade talks with Hansen and Šefčovič.

We are getting a sense of the work that lies ahead for the Šefčovič-Hansen tandem. Although it’s only February, the two Commissioners already had multiple exchanges with MEPs of the trade and agriculture committees about the EU-Mercosur Agreement. We’ll have many more sessions in 2025, as it seems that the deal will be only voted in early 2026. The road for ratification will be long and bumpy, and MEPs (particularly from agricultural constituencies) will put pressure on the Commission – look at the flood of parliamentary questions calling for protection of EU farmers against agri-food imports from Mercosur.

In defending the agreement vis-á-vis farmers, the Commission’s line is pretty clear: the quotas on sensitive products (beef, poultry, sugar) equals to little EU consumption, and imports’ compliance with EU’s sanitary and phytosanitary standards is not up for negotiation. As additional safeguard, Agriculture Commissioner Christophe Hansen will introduce a €1 billion “compensation fund” for farmers. On top of that, EU farmers and food industries will also be able to export more, thanks to more geographical indications protection and lower duties. In a nod to farmers, however, Hansen said it’s “not fair food imports from third countries contained residues of pesticides banned in the EU” at an event with the Irish sector recently.

From the European Parliament’s perspective, the debate on the Mercosur agreement is shaping around national rather than party lines, with French, Polish and Irish MEPs (even from centrist and pro-EU parties) unanimously against, as well Patriots, the Greens and the Left.

In this year of intense debate, it will be important to keep in mind the broader context, or, as farmers put it, the “cumulative effects” of EU trade and agri policy on EU agriculture. Hence, the Mercosur ratification will navigate a storm of inter-connected dossiers like the extension of trade preferences for Ukrainian agri-food, reduction of red tape and CAP.

(AI) chip on EU’s shoulder.

Before Trump went on his tariff spree, the outgoing Biden administration imposed similarly controversial export restrictions on AI chips. Not the crispy kind, but those that support AI models, chatbots and other types of AI-powered technology.

The restrictions divide countries into different tiers – tier 1 with unlimited access to American AI chips; tier 2 with capped access and reporting requirements; finally, tier 3 – full ban. Out of the lucky 18 in tier 1, ten are European states – hence, not all EU members managed to get on the list.

Uproar followed in the EU, most notably Poland, which didn’t make it to tier 1. Warsaw was not only slighted due to its position as a close US ally – the cap would also affect its burgeoning tech and military sectors. Commissioners Virkkunen and Šefčovič followed the news with a statement that Europe’s unrestricted access to AI chips is an “economic opportunity for the US, not a security risk,” though it didn’t address the single market split.

President Trump has the final say whether the rules will be enforced or not, and the likes of chipmaker Nividia are lobbying hard against it. With the new Chinese model DeepSeek breathing down the necks of American companies, the US might not want to give China another reason to work around the chips shortage. For now, we will have to let the (AI) chips fall where they may and keep you posted on further updates. One thing is certain – Brussels, even with its Chips Act, is not holding the bargaining chip.

Investment sCReaming.

Legislative work is now picking up on the reform of the FDI Screening Regulation, the key instrument of the Commission’s effort to improve the bloc’s economic security. Plus, the Commission released its Recommendation for Member States to also start monitoring outbound investments across the most important technologies. This happened after several months of delay, due to EU governments’ reluctance to give up competence in this area. But one thing at the time.

Rapporteur Raphael Glucksmann published his amendments to the Commission’s proposal on FDI screening. Music to DG TRADE’s ears, Glucksmann proposed to attribute investigative powers to Commission to better assess the security risks of FDIs, in case EU countries miss something… This will be hard to digest for the Member States, which also want a significant reduction of the scope of their mandatory screening, by removing the Commission’s excessive list of “critical technologies areas”. The two institutions are expected to agree on the respective text by end of March, and trilogues can start right after.

On outbound investment, being a non-binding recommendation, the degree of application by EU governments is uncertain. Still, there can be a significant impact on companies making investments abroad in semiconductors, AI and quantum technologies. The most “diligent” Member States could start asking for information related to not only merger and acquisitions, but also asset transfers, including IP, and greenfield investment. This review is to last 15 months and cover both ongoing and past transactions, going back to 1 January 2021. After this process, the Commission should have the necessary information to determine the risk of EU outbound investment, and then assess “whether further action is needed to address such risk” – not an ad-hoc regulation, companies hope.

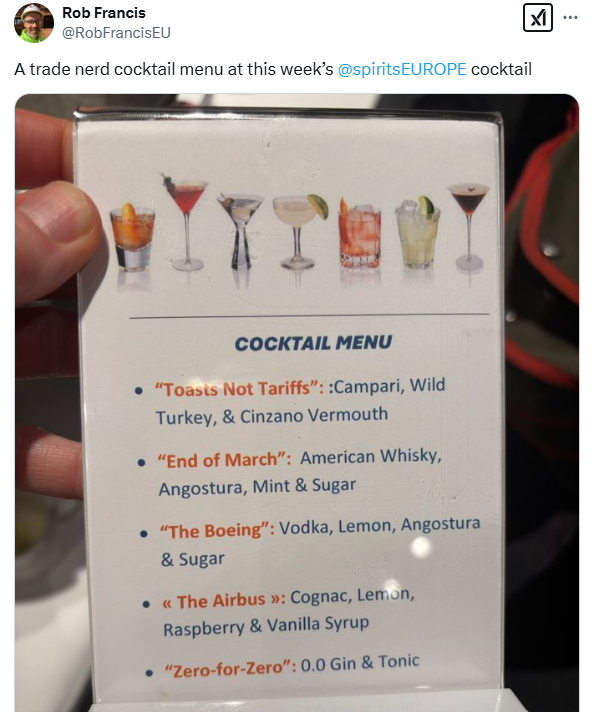

Over on X:

https://x.com/RobFrancisEU/status/1885266366229262516

A solid recap of the ongoing EU-US trade frictions

On our radar.

19-20 Feb I INTA committees gathers. Agenda still TBD but I would be surprised if it didn’t include something between Mercosur, EU-US relations, FDI screening.

27-28 Feb I All 27 Commissioners will travel to India for the bilateral Trade and Technology Council, first major trip after President von der Leyen’s confirmation. A clear sign of the EU’s will to explore new economic relations.

What we’re reading.

Brussels pushes ‘buy European’ procurement plan – Financial Times’ Andy Bounds reflects on the probably most disruptive point of the Competitiveness Compass: the potential introduction of a “European preference in public procurement for critical sectors and technologies“. The EU has previously challenged similar approaches in the UK or China. The review of the EU Procurement Directive will only be in 2026, but the challenge for foreign companies operating in the EU is already open.

“EU-Mercosur: The global alliance of herbivores starts today” – Commenting on the EU-Mercosur agreement by paraphrasing President’s Macron metaphor, Jonathan Packroff of Euractiv underlines that the Commission has shown the willingness “to go a different route than China and the US.” Amid the ongoing global trade turmoil, strengthening the EU trade network may be a good idea.

Still have questions? Drop a message.

Contact us if you would like to hear more about our trade expertise – info@secnewgate.eu or a.pilati@secnewate.eu.

Keep up to date with the latest trade news in town and subscribe to our newsletter.